Arleta, CA – April 4, 2023

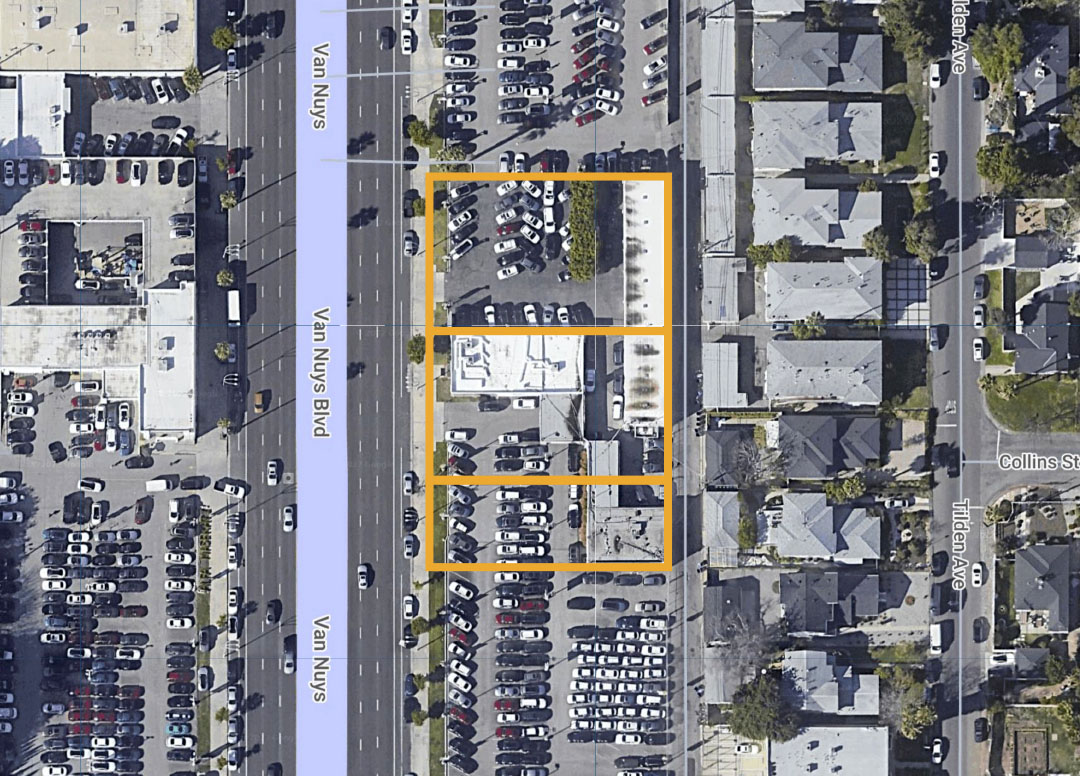

Executive Managing Director Yair Haimoff, Vice President Barry Jakov and Senior Associate Zach Rabinowitz of Spectrum Commercial Real Estate, Inc., are pleased to announce the recent sale of two multi-tenant commercial buildings that are situated on a large parcel located at 8907-8917 Woodman Avenue, Arleta, CA.

The subject property comprises of approximately 17,160 square feet of commercial space that is situated on approximately 70,000 square foot commercial zoned parcel. The property was 100% leased at the time of closing and consists of seven units and a large fenced rear lot.

The property is located in one of Los Angeles County’s most economically and culturally diverse neighborhoods in the San Fernando Valley. It is surrounded by single and multi-family homes, schools, shops, restaurants and other area amenities and is bordered by Panorama City, Pacoima, Mission Hills, San Fernando and Sun Valley with easy access to the 5, 118, 170 and 405 Freeways.

Our team successfully met Seller’s stated April 1st deadline by implementing an aggressive and strategic marketing campaign. We received multiple offers and brought the transaction to a successful close on time. It was a pleasure to work with both the Buyer and Seller. All parties cooperated with each other and overcame various obstacles to meet the closing deadline.

The property sold for $5,750,000.00.

Contact Brokers for more information.